Over the course of the past decade Chinese companies have created a wave of acquisitions across numerous sectors of corporate Germany. The involvement of Chinese companies in Germany’s economy ranges from car manufacturing to the financial sector, transport infrastructure, retail as well as high-tech businesses. These dynamics in China – Germany economic relations have created a mixture of mutual dependence and policy challenges for both Beijing and Berlin.

While bilateral trade is expanding there is rising concern that exposure to China requires added public scrutiny and greater enforcement capacity to screen Chinese investments in certain sectors. The final section of this report discusses the potential for a policy reset in Sino-German economic relations as a consequence of Chancellor Angela Merkel leaving office following the general elections in autumn 2021.

You may find the Policy paper by Dr. Jens Bastian, Senior Policy Advisor of ELIAMEP, in pdf here.

Introduction:

Over the course of the past decade Chinese companies, many of which are affiliated with the government in Beijing, have created a wave of acquisitions across numerous sectors of corporate Germany. The involvement of Chinese companies in Germany’s economy ranges from car manufacturing to the financial sector, transport infrastructure, retail as well as high-tech businesses. This investment wave is complemented by an expanding volume of bilateral trade which breached the threshold of 200 billion euros in 2019. In fact, China is the only country in the G-20 with which Germany has a (recurring and double-digit) trade deficit.

These dynamics in China – Germany economic relations have created a mixture of mutual dependence and policy challenges for both Beijing and Berlin. While bilateral trade is expanding and German automobile executives are celebrating record sales in China – “It’s almost too good to be true” (Ola Kallenius, the chief executive of Daimler-Benz in October 2020) – there is also rising concern that exposure to China requires added public scrutiny and greater enforcement capacity to screen Chinese investments in certain sectors.

This contribution examines the plethora of investments that Chinese companies initiated over the course of the past five years in Germany. It primarily focuses on some key acquisitions and equity shareholdings. But the pull factor of Chinese investments has also given rise to pushback against China among the German public, parts of the media and increasingly among policy makers in Berlin. In the latter case regulatory policy interventions are emerging at the level of federal government that focus on investment screening in sensitive sectors, transparency requirements and rule of law requirements.

The final section of this report discusses the potential for a policy reset in Sino-German economic relations as a consequence of Chancellor Angela Merkel leaving office following the scheduled general elections in late September 2021. After her 16-year tenure the successor in office faces the opportunity and challenge of changing the status quo in this key foreign policy bilateral relation. The demand for change has accelerated during the Covid-19 pandemic and the economic consequences it is creating in Germany.

Historical context

During the past decade the term ‚Silk Road‘ has received increased attention across Europe. Frequently, the prefix ‚New‘ is added to Silk Road. In the German media the term is almost exclusively associated with China and its investment expansion abroad. The New Silk Road is used as a synonym for China’s flagship foreign economic policy, the Belt and Road Initiative (BRI). But historically and geographically the term Silk Road is connected to more countries and transport routes than only China. The German geologist Ferdinand von Richthofen coined the term in the late 19th century. But he did so, using it in the plural, when he wrote (in German) about the „zentralasiatischen Seidenstrassen bis zum 2. Jahrhundert. n. Chr.“ (the central Asian Silk Roads until the 2nd century A.D.).[1]

The German scientific interest in China and beyond during the 19th century was complemented by colonial imperialism. It has widely been forgotten that Germany declared parts of eastern China as its own territory. In 1897, the German Reich acquired the port of Tsingtau. The German navy used the port as its base in East Asia. During the peace negotiations in Versailles after the end of the first World War the victorious allies agreed – with the approval of the Chinese delegation – that Germany’s territories in eastern China would be handed over to Japan and not back to China. The protests of Chinese students against this decision created the “4th May Movement” in Tiananmen Square in 1919.

“As early as 1957, before diplomatic relations were established, an initial commercial cooperation agreement between the Federal Republic of Germany and China was signed.”

As early as 1957, before diplomatic relations were established, an initial commercial cooperation agreement between the Federal Republic of Germany and China was signed – not by the governments, which had no official contacts, but between the German Committee on Eastern European Economic Relations and the China Council for the Promotion of International Trade (CCPIT). This bilateral agreement subsequently helped pave the way towards diplomatic relations between then West Germany and China. Agreeing on the status of West Berlin repeatedly delayed the conclusion of negotiations. Finally, on October 11, 1972, diplomatic relations were officially established between Beijing and Bonn (then the capital of West Germany).[2]

“By contrast East Germany and China signed a trade pact in October 1950 but did not have official diplomatic relations.”

By contrast East Germany and China signed a trade pact in October 1950 but did not have official diplomatic relations. In the absence of such a commitment both sides did engage in a gradual rapprochement. A Chinese delegation led by then foreign minister Wu Xueqian visited East Berlin in June 1986. The visit was reciprocated in October of the same year by Chairman Eric Honecker traveling to Beijing. It was the first official visit by a Communist leader of the Eastern Bloc after the rupture between China and the Soviet Union in 1961. The bilateral trade pact included soybeans, vegetable oils and tea imports from China while East Berlin exported mining pit equipment, optical instruments and medical as well as clinical supplies to Beijing.[3]

“Since March 2014, the bilateral relations were upgraded to a “comprehensive strategic partnership”.”

After formerly establishing mutual diplomatic recognition West Germany and China also signed a trade agreement in 1972. But the volume of bilateral trade initially remained very low. In 1973 trade was valued at just one million German marks (approximately 500.000 euro). It took another two decades until the German government of Chancellor Helmut Kohl presented its so-called “Asia Concept” in 1993. The region was described as offering huge potential for cooperation, particularly for German exports. Industry representatives from leading German corporations were encouraged to invest throughout the continent – especially in China. This conceptual breakthrough proved a watershed for bilateral trade and foreign investment. In 2004, Sino-German relations were elevated to a “strategic partnership in global responsibility”. Since March 2014, the bilateral relations were upgraded to a “comprehensive strategic partnership” (emphasis added).

The structural dependence of the German economy on China

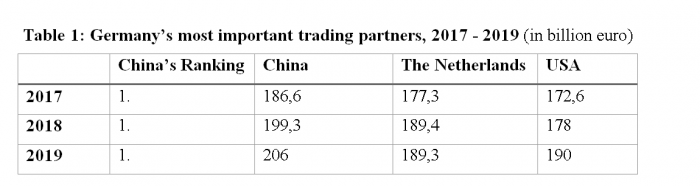

As an export-oriented economy, Germany is relying heavily on its capacity to trade with China. In 2019, China was Germany’s single largest trading partner for the fourth year in a row. For the first time the total volume of bilateral trade breached the threshold of 200 billion euro in 2019. As table 1 illustrates, trade between both countries from 2017 to 2019 increased by more than ten percent.

Sources: For 2017 see Süddeutsche Zeitung, “Alle Wege führen nach China”, 22. February 2019. For 2018 see Statistisches Bundesamt, annual data https://www.destatis.de/DE/Presse/Pressemitteilungen/2019/02/PD19_057_51.html, for 2019 see https://www.destatis.de/DE/Themen/Wirtschaft/Aussenhandel/handelspartner-jahr.html.

The rise in volumes of bilateral trade between China and Germany has some distinct characteristics. In 2019, German exports to China totaled 96 billion euro, the third highest level after exports to the USA (118.7 billion euro) and France (106.6 billion euro). This configuration changed substantially in the first six months of 2020, chiefly as a result of the economic consequences resulting from the Covid-19 pandemic. During this period, China became Germany’s largest export market. Given the combination of lockdowns, border closures and travel restrictions among EU member states and in the United States in the second quarter of 2020 Sino-German trade expanded at the expense of commercial markets in the EU and the U.S.[4]

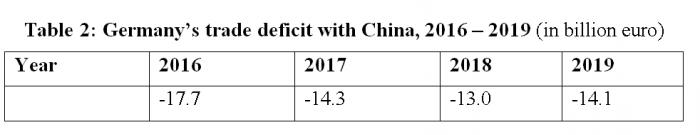

“…Germany has a trade deficit with China which reached 14.1 billion euro in 2019.”

The fact that China continues to be Germany’s leading trading partner is primarily based on the volume of imports from China. Nowhere else does Germany purchase more products than in China, namely 110.1 billion euro in 2019. This difference in volume and ranking of exports and imports is reflected in the fact that Germany has a trade deficit with China which reached 14.1 billion euro in 2019 (see table 2 below). Compared to 2018, Germany’s trade deficit with China increased in 2019, while it was almost the same when compared with 2017. The highest level to date was reached in 2016 when the trade deficit amounted to 17.7 billion euro.

Source: Same as in table 1, based on author’s calculations.

“…in 2019 Germany held the highest share of EU exports to China (42.76 percent) and 18.29 percent of imports, respectively.”

The data presented underlines that the changing trade configurations in the global economy are increasingly reflected in Germany’s trading patterns and volumes with other countries. The USA remain – for the time being – the most import export destination for German products. But China is fast catching up while Berlin’s the trade deficit with Beijing continues to reach double digits. When placed in a European perspective, in 2019 Germany held the highest share of EU exports to China (42.76 percent) and 18.29 percent of imports, respectively. Among the other EU member states, no other country reaches more than 10 percent of European exports to China.[5] In short, China’s footprint in Germany’s political economy is considerable. As the next sections illustrate, this engagement is further reflected in numerous investments and acquisitions by Chinese companies across Germany’s economy during the past five years.

Chinese anchor investments in Germany

Over the course of the past decade Chinese companies have made various strategic anchor investments across sectors of corporate Germany. Through a mixture of equity shareholdings and outright takeovers China’s footprint in German car manufacturing, the banking sector, hotels, transport infrastructure as well as retail and robotics has expanded and diversified. The nature of these anchor investments is long-term and corresponds in numerous cases to strategic industrial policy objectives of the political authorities in Beijing.

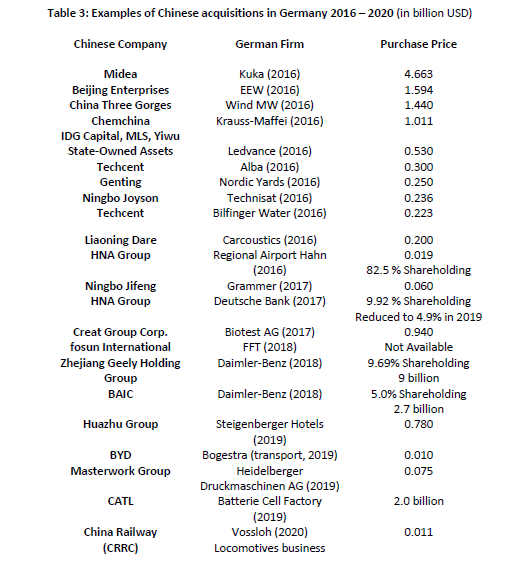

Chinese acquisitions and investments in Germany have received increased public attention during the past five years. In 2016 alone Chinese investors accounted for 309 takeovers of and equity shareholdings in German companies. But Chinese investments are not a recent phenomenon. A historical perspective helps in illustrating how Chinese companies have applied technological benchmarks and financial engineering to Made in Germany companies since the early 1970s. These benchmarks and such financial ingenuity still apply fifty years later in Sino-German economic relations, albeit with a much higher degree of public scrutiny and in a rising number of cases that include regulatory pushback.

In March 1974, the China National Technical Import Corp. invested 500 million German Marks (equivalent to more than 255 million euro) in a German consortium to build a cold rolling mill in China. The negotiations lasted a decade, implying they commenced before the formal establishment of bilateral diplomatic relations between Beijing and Bonn (the capital of West Germany until unification in 1990). The West German consortium was chosen against competition from Japan. Equally, the Chinese investment in the mill was to serve as the basis for technological transfer and domestic development capacity in the sector.[6] The financial details included an advance cash payment of 90 percent (!) of the investment in German Marks by the Bank of China to Deutsche Bank. Even potential litigation issues were addressed in the contract details. The Sino-West German cooperation in 1974 agreed that Stockholm and a Swedish arbitration court would rule on possible commercial disputes.

Almost half a century after this anchor investment, officially reported Chinese investment in Germany reached a record level of 12 billion euros in 2017 and declined to 8.8 billion euros in 2018.[7] The volume of Chinese FDI in Germany fluctuated considerably during the decade 2010-2020. At times during this period one or two acquisitions accounted for more than 80 percent of total Chinese FDI in a single year (in particular in 2016 and 2018, see table 3). Such exceptional[8] years notwithstanding, Chinese interest in German companies continues to be large and is increasingly diversified across sectors. However, as we shall argue what raises concern is the lack of transparency in certain transactions and the complex financial arrangements to support various Chinese acquisitions.

German companies acquired by various Chinese firms are predominantly concentrated in the manufacturing sector, with a special emphasis on technological innovation. The anchor investment that reflected this focus concerned the acquisition of the robot manufacturer Kuka to the private Chinese home appliance producer Midea in 2016. The German government initially resisted the takeover by Midea. Then Economy Ministry Sigmar Gabriel (from the Social Democrats, SPD) sought to limit the size of Midea’s stake to 49 percent, arguing that Kuka was a national champion in a key German industry. After the major German shareholders sold their stakes, Midea held 94.55 percent in Kuka thereby invalidating any ministerial proceedings against the takeover.

By contrast, the takeover of the German semi-conductor company Aixtron by China’s Fujian Grand Chip Investment Fund was blocked in the same year. But the final decision to do so was not taken in Berlin. Rather, the outgoing Obama administration in Washington stopped the acquisition based on national security risks in late 2016. Fujian was prevented from buying Aixtron’s U.S. subsidiary following an assessment by the Committee on Foreign Investment in the United States (CFIUS), an inter-agency task force under the Treasury Department.[9] Between the acquisition of Midea and the failed takeover of Aixtron in the same year two trends of Chinese investments in Germany can be identified.

- For one, integration into industrial policy priorities. China’s acquisition and investment drive diversified over time into different sectors. Two equity shareholdings by different Chinese companies in the German car manufacturer Daimler Benz exemplify this trend (see section 3.1 for more details). These moves reflect China’s ambition to expand manufacturing networks and integrate these into global supply chains.

- Secondly, investment into assets with name recognition. Acquisitions such as the hotel chain Steigenberger[10] by the Huazhu Group illustrate a focus on high-profile brand names. The secretive nature of acquiring a sizeable stake in Germany’s largest lender Deutsche Bank by HNA reflect both trends simultaneously (see section 3.2 for more details).

These and numerous other acquisitions during 2016 – 2020 underscore the potential that Chinese companies have identified in the German corporate ecosystem. But the expanding nature of these investments across sectors has received a mixed welcome. While many business representatives embrace these opportunities, others such policy makers in Berlin, media journalists and a rising share of the German public see in these acquisitions a threat and a sell out of Made in Germany.

“German car manufacturers, banks, hotels and high-tech companies face a rising challenge of public scrutiny as regards their Chinese cooperation and engagement.”

German car manufacturers, banks, hotels and high-tech companies face a rising challenge of public scrutiny as regards their Chinese cooperation and engagement. The increase in Chinese acquisitions of German technology and knowledge-based companies over the course of the past decade has raised some uncomfortable questions for German corporate representatives. These include, inter alia, how German businesses address China’s human rights record. Dealing with corporate China requires dealing with governmental China under President Xi Jinping.

This overview does not claim to be exhaustive for the period identified. The author is aware that there are numerous other, smaller acquisitions that have taken place by Chinese companies in Germany since 2016. Source: Compilation by the author.

a) Sino-German cooperation in the car manufacturing sector

As table 3 illustrates, Chinese companies proceeded in 2018 with various shareholding investments in Daimler-Benz, the German manufacturer of premium cars. These investments coincided with a record year of German car sales in China. More specifically, in 2018 the three leading German car manufacturers – BMW, Daimler and Volkswagen (VW) – increased their sales in China by a combined five percent to more than 5.1 million units. This increase was achieved against a declining trend of European car sales in China! The market share of Germany’s flagship car manufacturers in China increased by 1.7 percent and reached 21.8 percent in 2018.[11] With such export levels and revenue upside Germany’s automobile leaders see China as a “second domestic market” (zweiter Heimatmarkt).[12]

Daimler’s main China joint venture partner is the BAIC Group (Beijing Automobile Group Co). Daimler announced in 2019 that the BAIC Group would seek to increase its five percent shareholding in the German car manufacturer to ten percent. BAIC is currently Daimler’s third largest shareholder. If the stake reaches ten percent, BAIC would become Daimler’s biggest shareholder, surpassing its Chinese automaking rival Zhejiang Geely Holding Group. The privately held Geely Group secretly acquired a 9.69 percent stake in the German automaker in early 2018. Secretive because the stake was acquired through a combination of Hong Kong shell companies, derivatives[13], bank financing and structured share options. These trades took place without notifying Daimler representatives nor the German capital market authorities. In short, they were executed under the radar of German regulatory and corporate transparency requirements.

“The equity stake in Daimler represented the single largest auto investment by a Chinese company in Europe.”

In 2017, China accounted for 27 percent of all cars sold by Daimler worldwide.[14] The Chinese competition between BAIC and Geely as to who is – or will be – the biggest shareholder in Daimler is instructive. Not only does it reflect the shareholders’ ambition to be seen as the German automaker’s senior-most partner in China. Moreover, both companies have manufacturing joint ventures with Daimler in China. BAIC and Daimler operate two factories in Beijing through the automakers’ joint venture, Beijing Benz Automotive. They also have a commercial vehicle joint venture, Foton Daimler Automotive (BFDA). Starting in 2022, Geely and Daimler established a joint venture to build the next generation of Smart electric cars exclusively in China. The Geely-Daimler cohabitation remains an uneasy one.[15] In the German public and among sector analysts Geely[16] was seen as an invader through unsolicited stake building in a European car manufacturer. The equity stake in Daimler represented the single largest auto investment by a Chinese company in Europe. Furthermore, such volumes of overseas investment by a private Chinese company can hardly be carried out without the implicit approval of decision makers in Beijing.

As shall be illustrated in section 3.2., Geely’s investment in Daimler took place when another flagship Chinese investment in Germany started to disintegrate because of excessive overseas financial exposure. In addition, we have to bear in mind that the equity stake in Daimler and the forthcoming joint venture for the construction of Smart electric cars serves both automobile companies and industrial policy objectives in China. Geely chairman Li Shufu argued that “this particular investment, our aim is to support the growth of the Chinese auto industry through the growth of Geely to serve our national strategies.”[17] The industrial policy concept titled Made in China 2025 seeks to establish the country as a world leader in the production of electric vehicles. National champions are to dominate in high tech industries such as electric mobility and batterie cell production.

The November 2019 publication of leaked documents exposing the internment of at least a million Uighurs and other Muslims in Xinjiang has drawn attention to the operations of German [car] manufacturers in the Chinese province.[18] As a result of the publication of the ‘China Cables’ in the German media, various companies have had to explain their business practices in the province. The list of firms operating in Xinjiang reads like a who’s who of corporate Germany. To illustrate, since 2013 VW operates a manufacturing factory with 650 employees in Urumqi, the capital of Xinjiang. In 2016, the chemical company BASF opened two small factories in Korla, the second-largest city in Xinjiang with 120 employees. Siemens AG the largest industrial manufacturing company in Europe cooperates with the Chinese armaments firm CETC in Xinjiang.[19]

Members of the German Bundestag (the federal parliament) who had criticized China’s treatment of the ethnic Muslim Uighurs in Xinjiang have been prevented from traveling to China. In November 2020, the human rights committee of the Bundestag addressed the situation of Uighurs in the country. The Chinese embassy in Berlin promptly demanded that the committee “stops, under the guise of human rights, to denigrate China and refrain from intervening in China’s internal affairs.”[20]

b) Sino-German cooperation in the financial sector

In 2015, Fosun International acquired the 219-year-old Frankfurt-based private bank Hauck & Aufhäuser for 210 million euro. The acquisition was the first outright Chinese takeover of a German bank. Two years later in October 2017, Hauck & Aufhäuser served as the investment bank adviser for Fosun to acquire the German robot manufacturer FFT. While Fosun’s acquisition of Hauck & Aufhäuser signaled China’s entry into the German financial sector, it hardly attracted public scrutiny. That perception changed radically when the Hainan-based Chinese group HNA secretly built a 9.9 percent equity holding in Deutsche Bank in early 2017. The equity investment made HNA Deutsche’s largest shareholder. HNA established the debt-financed equity stake through an Austrian fund called C-Quadrat and various offshore holding companies. In addition, the Swiss bank UBS provided a derivatives product to further facilitate the HNA stake in Deutsche Bank.

“…the first outright Chinese takeover of a German bank.”

The financing structure of the 9.9 percent holding has similarities with the shadow banking system with which Geely acquired its stake in Daimler-Benz. Instead of holding a sizeable direct stake, HNA used various financial instruments and banking intermediaries to construct its shareholding in Germany’s leading lender. This strategy served two purposes. For one, HNA used the strategy to discreetly build an equity holding in a company without immediately drawing the attention of German and/or European banking supervisors. Secondly, the complex financing structure allowed the Chinese group to have corporate impact while employing very little of its own capital resources.

“Hainan-based Chinese group HNA secretly built a 9.9 percent equity holding in Deutsche Bank in early 2017.”

Adding to the controversy of HNA’s actions was the unclear business rationale of the company’s stake in Deutsche Bank. The HNA Group is primarily involved in air travel, tourism, real estate and logistics. Its foray into the German banking sector was a first-time equity involvement in a financial institution outside China.[21] The debt financed shareholding was structured by Chinese state-owned policy banks and international investment banks. In June 2018, the government in Beijing provided HNA with a liquidity facility but in return tasked HNA with an immediate disinvestment of various overseas assets.

The lesson learned from this Chinese intervention does not only concern a sense of déjà-vu as regards the lack of transparency and secretive financing arrangements. Instead, HNA’s intervention is also a sobering lesson of financial over-extension and subsequently forced retrenchment by a Chinese conglomerate. Since the initial acquisition in early 2017, HNA has had to gradually cut its holding in Deutsche Bank from 9.9 percent to first 7.6 percent (in April 2018) and again to 6.3 percent in February 2019. This divestment process was made necessary as the result of HNA’s debt financed overseas assets which also included large stakes in the hotel groups Hilton Worldwide and the Spanish NH Hotels. The strategy U-turn became necessary following the accumulation of debt obligations exceeding almost USD 100 billion.

For readers knowledgeable in the complex details of derivatives financing, HNA’s gradual divestment from Deutsche Bank was not only due to its accumulated debt pile. The derivative product involved was a so-called ‘funded equity collar’. This instrument is used as a hedge against a drop in a company’s share price. However, with a falling share price the holder of the collar can either be forced to sell (part of) its stake or is obliged to mobilize additional resources to cover the derivatives facility. As HNA was not in a position to finance more debt, the ‘collar’ in effect turned into a constraining neckline which forced the Chinese to sell down assets. Put otherwise, derivatives exposure can be a risky proposition. While it gives you the option to buy voting rights in a company it does not provide direct share ownership. Nor can such a derivate instrument be interpreted as a commitment by HNA to act as a medium- to long-term strategic investor in Deutsche Bank.

“Since more than a decade Deutsche Bank pursued an expansive and controversial strategy to attract business in China.”

However, this Sino-German investment is not a one-way street from HNA’s Hainan province to the headquarters of Deutsche Bank in Frankfurt. Since more than a decade Deutsche Bank pursued an expansive and controversial strategy to attract business in China. It is a key European player managing initial public offerings (IPO) in China, e.g., in 2006 the IPO of Industrial and Commercial Bank of China. It has been active in so-called ‘relationship hires’ in China, i.e., hiring politically connected consultants.[22] In May 2006, Deutsche Bank became the first German lender to acquire a significant stake in a Chinese Bank. Deutsche Bank purchased a 9.9 percent equity stake in Xua Xia Bank, a midsize lender in Beijing. Four years later Deutsche Bank increased its shareholding in Xua Xia Bank to 19.99 percent for a price of USD 822 million. But in late 2016, Deutsche Bank reversed course and sold its entire stake in Xua Xia Bank to the insurer PICC Property and Casualty. In short, the fact that Deutsche Bank attracted the interest of HNA cannot be viewed as a complete surprise. Prior to HNA’s investment in Deutsche Bank the German lender had sought to make its mark in China since more than a decade.

The changing nature of Sino-German relations

“…the structural dependence of the German economy on China is deeply entrenched across sectors.”

As illustrated in the previous sections, the structural dependence of the German economy on China is deeply entrenched across sectors. But what is also emerging as a new reality in the German political economy is the degree of pushback that Chinese investments are starting to receive. The experiences of German companies such as Kuka, Aixtron, Deutsche Bank and Daimler Benz with Chinese investors over the course of the past years has contributed to rather unintended consequences for foreign acquisitions from non-EU countries. They subsequently triggered political and regulatory interventions which sought to recalibrate the focus of investment screening at the domestic and European levels.

“The federal government’s regulatory changes […] in 2017, 2018 and 2020 can be characterized by two guiding principles. For one to strengthen defensive instruments. […]The second guiding principle was the determination of German regulators to Europeanize the issue.”

The federal government’s regulatory changes to foreign investors originating outside the EU were initially strongly influenced by the experience of the Kuka takeover in 2016. The subsequent reform steps undertaken in 2017, 2018 and 2020 can be characterized by two guiding principles. For one to strengthen defensive instruments vis-à-vis future non-EU investors in critical infrastructure and technologies. While China was not explicitly mentioned as the primary target country of such defensive economic policies, the sectors identified in these three regulatory interventions clearly suggested that they primarily accounted for companies from China. The second guiding principle was the determination of German regulators to Europeanize the issue, i.e., together with fellow EU member states (in particular France) to seek regulatory guidance and a certain degree of legal harmonization from the EU executive in Brussels. Key policy areas under review and subject to regulatory change by federal authorities in Berlin and in Brussels include:

- Transparency requirements. In July 2017, the German government started reforming the definition of “critical infrastructure” in which foreign takeovers of companies from non-EU investors could be banned on national security grounds. The sectors included energy networks, water utilities, telecommunication, IT security firms as well as hospitals. In a second step in December 2018, the threshold for review by a federal ministry and for the notification obligation towards the Ministry in such critical infrastructure was reduced from 25 percent of voting rights in a German company to 10 percent.[23] This new rule applied to “sensitive” industries, in particular for the defense sector, critical infrastructure and the media industry.

- European investment screening: The European Commission introduced foreign investment screening regulations in March 2019 (Regulation 2019/452).[24] The transposition process into national legislation gave EU member states far-reaching leverage to modify the proposals from Brussels. The Commission’s regulatory guidance focused on capital investments from third countries, in particular non-EU external actors. Among the novel elements in the EU regulation is Article 8.1 which states that where “the Commission considers that a foreign direct investment is likely to affect projects or programmes[25] of Union interest on grounds of security or public order, the Commission may issue an opinion addressed to the Member State where the foreign direct investment is planned or has been completed.” The regulation further states in Article 8.3 that this applies to “critical infrastructure, critical technologies or critical inputs which are essential for security or public order.”

- Redefining critical sectors In November 2019, as part of the national transposition of EU investment screening regulations the Economy Ministry in Berlin included “critical technologies”. Added to the catalog were robotics, biomedicine, artificial intelligence, semi-conductors and quantum technology. If the ministry identifies an “expected impairment” (voraussichtliche Beeinträchtigung) of public order or national security (not a “real threat” as stated previously), then it can intervene and block the proposed foreign investment by a company from a country originating outside the EU.[26]

Let us illustrate this review process with some empirical examples. In July 2018, the federal Ministry for Economy stopped the attempted Chinese purchase of the country’s largest power grid operator, 50Hertz Transmission GmbH. The manner in which the acquisition by State Grid Corp. of China was rebuffed reflected an unprecedented investment pushback against a Chinese company in Germany. The state-owned German investment bank KfW (Kreditanstalt für Wiederaufbau) was mobilized to act as a sovereign wealth fund which is not part of its operational mandate. KfW purchased a 20 percent equity holding (valued at 770 million euros) in 50Hertz. The Ministry argued that “on national security grounds, the federal government has a major interest in protecting critical energy infrastructure…citizens and the business community expect a reliable energy supply”.[27] But KfW is also active on the other side of Sino-German investments. Between 2013 and 2018 the German lender provided 630 million euro in development assistance to China, primarily financing projects in vocational training.[28]

The defensive move by KfW and the Economy Ministry in Berlin to protect a critical energy infrastructure asset from Chinese ownership constituted a first outright ban. Invoking the potential of a national security threat highlighted to what degree a rising public backlash against certain Chinese investments had reached Chancellor Angela Merkel’s inner cabinet. In the same month the Economy Ministry also decided to block the sale of machine tool company Leifeld Metal Spinning AG to Yantai Taihai, a leading player in China for nuclear casting and forging products. The lead ministry argued that the sale would be a “risk to public order and safety.”[29]

“…to scrutinize in greater detail and even ban acquisitions and takeovers from non-EU external actors. Invoking national security grounds to do so is becoming the new default reasoning.”

Both examples underscore at the political level the increased willingness of federal authorities to intervene in investment proceedings that included Chinese firms seeking assets in companies and sectors deemed “critical” for the German economy. While these two interventions focused on China, they nevertheless reflected a larger trend within the federal government in Berlin namely to scrutinize in greater detail and even ban acquisitions and takeovers from non-EU external actors. Invoking national security grounds to do so is becoming the new default reasoning.[30]

Seen in a wider context while bilateral trade volumes are setting yearly records, Sino-German investment ties have become subject to new regulatory limits. The Economy Ministry argued that critical infrastructure should not fall into the hands of non-EU external investors, be they from China, Russia or anywhere else outside the EU. This premise sought to reform legal thresholds in M&A transactions in sectors deemed strategic and potentially subject to national security considerations. In the course of 2019, the regulatory reforms in Germany translated into more than 70 investment screening investigations. 13 of these cases screened concerned companies from China.[31]

“It is not a coincidence that the objective to confront non-EU companies’ investment momentum is taking place as Germany is presenting its own version of “Industriestrategie 2030” (industrial strategy 2030).”

However, lurking behind references to national security and the protection of public order through updated investment screening is a subtext that should not be underestimated. The German Economy Ministry is undertaking these legal revisions and simultaneously recalibrating its industrial policy objectives. It is not a coincidence that the objective to confront non-EU companies’ investment momentum is taking place as Germany is presenting its own version of “Industriestrategie 2030” (industrial strategy 2030).[32] This strategic outlook includes the identification of and support for so-called “European champions”. While some employers’ associations (e.g., VDMA)[33] with considerable exposure to foreign investment criticize the strategy as a protectionist economic trajectory, others welcome the focus on shielding specific sectors from non-EU external actors.

But the empirical evidence of such an industrial strategy suggests that the political rhetoric faces considerable obstacles on the ground. One sector where the German government is trying to create such a domestic champion concerns the production of batteries cells for electrical vehicles (EV). The leading German car manufacturers – Daimler-Benz, BMW, VW and Audi – purchase these batteries from manufacturers in South Korea (Samsung) and China’s CATL (Contemporary Amperex Technology), the world’s largest producer of batteries for electric vehicles. In order to rectify this discrepancy (or dependency) the federal government in Berlin supported the construction of a battery cell factory in Erfurt (Thüringen) in mid-2018. With the help of state subsidies and German research infrastructure the factory will deliver the first batteries in 2022. But there is a major catch in this arrangement. The factory will be Chinese! Where German companies hesitated to come forward, CATL is investing 1.8 billion euros in Erfurt to build the said factory.[34] In short, German subsidies are helping to finance a technology transfer from China to Erfurt, but with the Chinese company literally in the ‘driver’s seat’. Meanwhile, CATL is building its first batterie cell facility outside China and will ultimately benefit from the demand upturn in the European EV sector.

From structural dependence to interdependence

Despite the recent regulatory changes towards non-EU foreign investments, corporate Germany continues to attract and welcome capital from China; even during the Covid-19 pandemic. In May 2020, CRRC ZELC (CRRC Zhuzhou Locomotive Co, a subsidiary of the China Railway Rolling Stock Corporation Ltd. (CRRC) received approval from the German competition regulator, the Federal Cartel Office (Bundeskartellamt) to acquire the locomotives business unit of Vossloh AG. The Kiel-based company develops and produces diesel-electric locomotives. CRRC’s acquisition expands its range of opportunities in the European rail market and creates a further cornerstone in China’s ambition to operate a trans-European rail infrastructure network. There is no comparable European counterpart in the Chinese railway and locomotive market. The president of the Bundeskartellamt, Andreas Mundt, justified the approval of the acquisition as follows:

“Based on our investigations, we were able to exclude a considerable impairment of competition on the European shunter market as a result of the merger. Although the Chinese state strongly protects CRRC, which plays a key role in as many as two of its strategic plans, namely “Made in China 2025” and the “Belt and Road Initiative”, this case shows that while Chinese state-owned companies enter markets with substantial economic power, this does not necessarily pose a threat to effective competition.”[35]

The statement highlights a key, but frequently underrated characteristic of Sino-German economic relations. Both countries, for different reasons and in different sectors, need each other. Focusing solely on the dependency variable of specific German companies vis-à-vis China misses essential elements of the complex relationship. As illustrated in the previous sections the dependency argument is primarily based on large German companies doing business with and/or in China. But the backbone of German industry, the often heralded small and medium-sized manufacturing firms (the so-called Mittelstand) are much less involved with nor concerned about China.

“Both countries, for different reasons and in different sectors, need each other.”

By contrast, at the risk of self-destruction German car manufacturers cannot afford anymore to scale down from the vast Chinese consumer market and the technological innovation concentrated there, e.g., in EV mobility. 2019 proved to be a watershed year for the German automobile industry. For the first time in their history, they produced more cars in China than in their home market.[36] They can reassess their logistics and supply chains. They must anticipate being challenged in their country of origin about production facilities in China and corporate governance issues relating to human rights.

“Structural dependency from China can also include structural innovation enhanced by China.”

But the flip side of this dependency and its strategic re-evaluation is China’s existing dependency on certain characteristics of Germany’s political economy. Let us illustrate this dual aspect with an empirical observation. Structural dependency from China can also include structural innovation enhanced by China. The latter effect can clearly be identified in the magnitude of change taking place in Sino-German transport connectivity. China’s flagship foreign economic policy project – the Belt and Road Initiative (BRI) – includes the construction of new rail freight routes carrying Chinese goods to European destinations. The European railway hub for these Chinese freight trains is located in the German north-western city of Duisburg which features the world’s largest inland port. The Duisport is the western rail terminus of China’s land based BRI. In 2019, according to the Duisport Group[37] approximately 30 percent of total trade between China and Europe was transported by freight train and processed through the Port of Duisburg. Presently, every week up to 40 trains run between Duisburg and a dozen destinations in China.

Once associated with the West German rust belt and focused on transporting coal and steel from its inland port to other domestic and European destinations, Duisport is now a key connectivity link for Sino-German railway infrastructure along the European route of the BRI. Instead of fossil energy storage facilities Chinese companies and Duisport are building a new container terminal to cater for incoming rail traffic from China. In addition, in October 2019 Duisport announced a shareholder agreement with the China-Belarus Industrial Park Great Stone in Minsk. The construction represents a key railway logistics connection along the route between Duisport and China. Taken together, the image of Duisport during the past decades as a port for coal storage and transport is rapidly being replaced by a high-tech container turnover center that critically connects Europe with China.[38]

The Sino-German cooperation in Duisburg reflects rising levels of bilateral trade. It also highlights connectivity aspects of China’s Belt and Road Initiative. More than one hundred Chinese companies active in Duisburg illustrate the pull factor of Duisport. In that respect we can identify similarities between the Chinese activities in Duisburg and the investment of COSCO (Chinese Ocean Shipping Company) in Piraeus near Athens in Greece. In both cases an underutilized port in dire need of modernization attracted Chinese – and not (!) European – interest. Over the past decade both port facilities have become impressive corporate turnaround stories. In Duisburg COSCO’s subsidiary Cosco Shipping Logistics is investing 100 million euro together with Duisport, the Dutch HTS Group and Hupac from Switzerland to build Europe’s largest container terminal and thus expand the rail-land link of the BRI. In Piraeus, Cosco Shipping has committed to invest more than 600 million euros in the port to expand the sea-land link of the BRI.[39]

“The German and by extension European markets remain essential for Chinese exports, in particular the export of overcapacities produced in China.”

Let us draw a preliminary conclusion of this interdependency argument. Deepening Sino-German economic ties involve a mixture of growing dependency for certain manufacturing sectors and examples of expanding interdependency as a result of policy priorities, e.g., infrastructure connectivity linked to the BRI. In fact, the trade relations between both countries highlight mutual dependency.[40] The German and by extension European markets remain essential for Chinese exports, in particular the export of overcapacities produced in China (e.g., in construction materials such as steel, oil-refining overcapacity and solar panels). But there are other aspects of Sino-German interdependency which shift the focus of inquiry more towards Chinese companies.

The controversies over the 5G network provider Huawei Technologies Corp. is a case in point. A number of European countries have put in place policies that limit or even outright ban Huawei from competing for tenders in the development and installation of 5G. The United Kingdom is the most pro-active country. Telecoms providers operating in Britain must stop installing Huawei equipment in the UK’s 5G networks from September 2021 onwards. The EU member states Poland, Romania, the Czech Republic, Estonia, Latvia and Slovenia have all signed legally non-binding agreements with the U.S. government of President Trump to remove 5G equipment provided by “untrusted vendors” from their mobile networks, and to prohibit such vendors from bidding in public tenders in the future.

“Huawei cannot afford being excluded from the continent’s largest telecommunications market, i.e., Germany.”

Against this background of restrictions being considered or implemented by a rising number of European countries Huawei cannot afford to face similar obstacles in or being excluded from the continent’s largest telecommunications market, i.e., Germany. The importance of this market is not only related to its sheer size, namely more than 70 million citizens. The significance also rests in the observation that a potential exclusion or severe hardware and software limitations being imposed by the German government against Huawei would be interpreted as a formidable political statement, most prominently in Beijing, but equally in Paris, Vienna, Rome, etc. China’s ambassador to Berlin is well aware of this challenge to Huawei. In December 2019, Mr. Wu Ken openly threatened Berlin with retaliation if it were to exclude Huawei as a supplier of 5G wireless equipment, citing the millions of vehicles German carmakers sell in China.

“If Germany were to take a decision that leads to Huawei’s exclusion from the German market, there will be consequences…The Chinese government will not stand idly by.”[41]

Such intimidation by China’s top diplomat in Germany is unprecedented. Publicly threatening the use of China’s economic clout to secure a foothold in the German 5G telecommunications marketplace speaks volumes about China’s (diplomatic) assertiveness abroad. But it also informs a German audience that the objective of Chancellor Merkel to avoid mixing politics with [trade] economics when dealing with China is being openly contradicted by Beijing. The message of Chinese diplomats underscores the political and commercial importance Beijing attaches to Huawei’s continued and expanding market presence in Germany. The conditions for Sino-German 5G mobile telecommunication cooperation represents a critical test case of how this bilateral relationship will move forward in 2021 and beyond.

“The conditions for Sino-German 5G mobile telecommunication cooperation represents a critical test case of how this bilateral relationship will move forward in 2021.”

While the political debate over Huawei occupies policy makers in Berlin, developments on the ground create empirical facts difficult to ignore. And they cut both ways! Rheinmetall AG, an integrated technology group headquartered in Düsseldorf, Germany was contracted in December 2019 to build aluminum casings for Huawei’s 5G network in China. The order – worth roughly 150 million euro – is Rheinmetall’s first foray into the Chinese mobile telecommunications industry. Rheinmetall will partner with its Chinese joint venture Hasco (a car supplier) to provide and install the casings.[42] The example illustrates the interdependency of Huawei and German suppliers. Without foreign technology cooperation and market access (e.g., aluminum casings, semi-conductors, microchips, 5G equipment) China’s strategically most important technology company faces operational bottlenecks domestically and the risk of exclusion from key [European] markets.

The three leading telecommunications companies in Germany – Deutsche Telekom (DT), Telefónica Deutschland and Vodafone Germany – operate so-called multi-vendor strategies. Next to Huawei this also includes technology provided by the European manufacturers Ericsson and Nokia. All three German companies have extensive service contracts with Huawei which is considered cheaper than the aforementioned two European competitors. Telefónica announced in late 2019 that it intends to contract Huawei for its development of the 5G network. For the market leader DT, Huawei is a “strategic partner” that is “key for our 5G plans.” Huawei has described Deutsche Telekom as a “preferred customer” for its 5G equipment rollout in Germany.[43] The CEO of Vodafone Germany, Hannes Ametsreiter, warned that if the federal government in Berlin would exclude the Chinese network supplier from the 5G mobile communications standard it “would lead to the 5G expansion being delayed by up to five years and costing significantly more.”[44]

Any decision on the subject matter is a complex political and administrative process in Germany. It involves different ministries and regulatory agencies. The new 5G technology is first evaluated by the Federal Office for Information Security (BSI). Subsequently, the Federal Chancellery, the Foreign Office, the Ministry of the Interior and the Ministry of Economic Affairs have to coordinate their respective decisions. This procedure can include the exclusion of a service provider despite a positive safety assessment by the BSI. The role of parliament must also be considered. Political parties from the governing coalition and opposition legislators argue that a purely technical assessment for the approval of 5G is not acceptable. They make the case that prevailing political and legal conditions in the country from which a 5G service provider originates must be taken into consideration.[45] This conditionality does not explicitly mention Huawei, nor China. But it is clear as the light of day what the clause implies.

For the federal government in Berlin, any decision about including a non-EU service provider for the development of 5G networks would be facilitated by reaching agreement in another, related policy area, namely cyber security. In the past four years Berlin and China have been negotiating to finalize such an agreement which chiefly addresses curtailing industrial espionage. Both sides have rather different interpretations what constitutes industrial espionage via cyberspace and how a consultation mechanism between the two countries should discuss any such allegations.

Prospects for Sino-German relations in a post-Merkel era

Beginning in 2018, views of China in the media, among politicians and citizens have continuously grown more negative in Germany. This gradual shift in opinion vis-à-vis China could first be identified in the corporate environment. In early 2019, the Bundesverband der Deutschen Industrie (BDI, the Federal Association of Industry) issued a report that labelled China a “partner” and a “systemic competitor.”[46] The twin classification reflected an emerging acknowledgement among representatives of corporate Germany that business as usual with China faced limits within the BDI, a new regulatory environment defined in Brussels and Berlin as well as an increasingly sceptic German public.

“The shift in public opinion in Germany on China is remarkable and should be a matter of significant concern for policy makers in Beijing and investors from China.”

At several stages of this inquiry, we have made passing references to the Covid-19 pandemic. The pandemic has become an accelerator of ongoing transformations in Sino-German relations. Let us address some of its implications. The shift in public opinion in Germany on China is remarkable and should be a matter of significant concern for policy makers in Beijing and investors from China. According to the Pew Research Centre (2020)[47], distrust in Chinese President Xi reached unprecedented highs in Germany in the course of 2020. The increase in distrust has been especially sharp since the onset of the Covid-19 pandemic. Among the nine surveyed European countries (out of a total of 14 countries), Germany registered a double-digit increase from 61 percent in 2019 to 78 percent in 2020.[48] Negative views about China reached their highest levels in Germany since the Center began polling this topic more than a decade ago.

“The rise in unfavorable views of China in Germany in 2020 is directly linked to widespread criticism among citizens over how Beijing has handled and communicated the Covid-19 pandemic.”

The rise in unfavorable views of China in Germany in 2020 is directly linked to widespread criticism among citizens over how Beijing has handled and communicated the Covid-19 pandemic. This assessment was highlighted by a second public opinion survey carried out by the Central European Institute of Asian Studies (CEIAS), an independent think tank located in Bratislava (Slovakia). Based on a study of public opinion in 13 European countries on China conducted in September and October 2020, the CEIAS survey underlines that countries “with decisively negative popular views include Germany, France, the UK, and the Czech Republic”. Moreover, prior to and during the Covid-19 pandemic “Chinese investments are the most negatively perceived by respondents in Sweden, France, and Germany.”[49] Beijing’s repeated disingenuousness during the outbreak of the pandemic and its attempts at shaping the narrative of crisis management have worsened German public opinion about China, a shift echoed across other countries in Europe.

On Sunday, September 26th, 2021 German citizens will be called upon to cast their vote for a new Bundestag.[50] The general election will not only be significant as regards the outcome for individual parties and potential coalition options to form a new government. The ballot will also signal a historical changing of the guards. Chancellor Angela Merkel, in office since November 2005 and the longest-serving head of government in the EU will hand the chancellery over to her successor. In October 2018, Merkel had announced that she would not stand for re-election as chancellor. With the departure of Merkel and the uncertainty who will succeed her, numerous policy issues could be subject to recalibration. One such issue concerns Sino-German foreign economic relations. The bilateral relation could become more complex to navigate, for policy makers and companies alike.

“Chancellor Merkel’s China policy was increasingly based on transactional economics, particularly promoting the interests of German companies doing business in China.”

The consequences of Ms. Merkel’s departure and the political challenges that may follow cannot be underestimated enough, including in Beijing. Over the course of the past decade and-a-half Chancellor Merkel’s China policy was increasingly based on transactional economics, particularly promoting the interests of German companies doing business in China. Her mantra focused on the assumption that through trade and investment, Germany along with other western countries could influence China’s conduct.

There are more than 5.000 German companies registered in China which impact on the manner in which economic diplomacy is conducted in Sino-German relations. Whenever Merkel travelled to China, the delegation accompanying her included a large contingent of representatives from corporate Germany, most prominently the car industry. By contrast, for years she has – publicly – refrained from addressing the human rights violations of Uighurs in Xinjiang. She met the Dalai Lama once during her time as Chancellor, in 2007, two years after taking office. When Merkel traveled to Beijing in September 2019, she called for “dialog” and that the rights and freedoms of people in Hong Kong “must be guaranteed.”[51] Many across the political spectrum in German considered these remarks as too soft on and accommodating towards China.

Among the three candidates in the Christian Democratic Union (CDU) vying to lead the party and thus seeking the nomination as the candidate for chancellor in the forthcoming elections is the MP and head of the foreign affairs committee of the Bundestag, Mr. Norbert Röttgen. He is an outspoken critic of China and has argued in favor of excluding the telecommunications company Huawei Technologies Co. from the implementation of Germany’s 5G network. Mr. Röttgen’s line of argument is primarily based on national security considerations. By contrast, Chancellor Merkel has been reluctant to publicly address such concerns or take sides. While the former advocates a more robust agency for Germany vis-à-vis China, Ms. Merkel rather reflects the limits of such agency.[52]

“There is a growing awareness among German policy makers to right-size Chinese foreign direct investment.”

There is a growing awareness among German policy makers to right-size Chinese foreign direct investment. This striking shift in German attitudes towards China is the result of a disillusionment among decision makers in Berlin. Chancellor Merkel’s engagement with China rested on the assumption that economic commitment, increased trade volumes and investments could indirectly also yield elements of political liberalization in China. This assumption is increasingly being called into question in Germany. It was grounded in a historical precedent that continues to exercise a certain degree of influence among policy makers in Germany. Its roots can be traced back to the notion of ‘Wandel durch Annäherung’ (change through approximation) when West Germany engaged in extensive political and commercial ‘approximation’ with East Germany during the 1980s. In the course of Merkel’s time in office China has changed considerably and business with China is highly profitable for many larger companies. But Merkel’s interpretation of convergence, i.e., change in China as economic ties deepen has not materialized the way she and others in Berlin had hoped.

“In September 2020, German foreign ministry officials unveiled a new “Indo-Pacific” strategy that focuses on stronger economic partnerships with Japan, South Korea, Australia and India.”

In other policy fields linked to China Germany is in fact starting to recalibrate its strategic priorities. In September 2020, German foreign ministry officials unveiled a new “Indo-Pacific” strategy that focuses on stronger economic partnerships with Japan, South Korea, Australia and India while arguing to reduce commercial and investment reliance on China.[53] The policy guidelines also contain references to security implications with carefully worded criticism of China’s actions in the South China Sea. The new strategy is a significant U-turn for Berlin. During the past decade Germany had shaped its foreign policy strategy in Asia primarily around China.

By contrast, the German foreign ministry has not published a comprehensive China strategy. If it does indeed exist, it is not available to the public. The reasons for such a lacuna are not known and Germany is not an outlier among European countries in that respect. To date, two EU member states have published such a country strategy vis-à-vis China. In 2017, Slovakia’s government published an extensive “Strategy for the Development of Economic Relations with China 2017-2020”.[54] In 2019, the Dutch government established a comprehensive China Strategy and made it available for public debate.[55] Given the economic and commercial importance of Sino-German relations the absence of a publicly available strategy document specifically on China is surprising. This deficit cannot be explained by instead referring to EU strategic priorities on China which the German government endorses and actively promotes.

Chancellor Merkel’s focus on Germany’s strategic partnership with China will not be easily reversed, provided this would be the political objective of her successor. Irrespective of who follows her in office in late 2021, there are a number of policy fields where both countries will continue to share common goals and can drive joint initiatives. These include:

- China’s commitment to carbon neutrality by 2060 and Germany’s emphasis on the impact of climate change offer sufficient ground for bilateral cooperation and multilateral engagement in various international fora.

- Both China and Germany share an interest in strengthening the 2015 nuclear agreement with Iran. The re-inclusion of the U.S. administration under a President Joe Biden is equally a common objective of Beijing and Berlin.

- Sino-German relations also have enough political space to converge on issues related to the Covid-19 pandemic. German and Chinese companies are cooperating in joint vaccine research, scale production and the logistics of supply chains distributing the vaccine. German companies critically depend on Chinese pharmaceutical and chemical imports in vaccine research and production.

- At the corporate level Sino-German relations have a mutual interest in resolving legal disputes arising from restrictions imposed during lockdowns and supply chain disruptions because of travel and transport constraints. The government-mandated measures against the Covid-19 pandemic have adversely impacted cross-border business between both countries, leading to an increase in litigation cases awaiting resolution.

“It remains to be seen how the new investment screening regulations can be enforced against the complex ownership structures of many (state-owned and subsidized) Chinese firms.”

To conclude, since 2016 China is Germany’s largest trading partner. But China is not a ‘normal’ partner. The various investment screening regulations introduced in Germany and at the EU level in the course of the past five years underline how far the process of normalization still has to go in Berlin and Brussels vis-à-vis Beijing. It remains to be seen how the new investment screening regulations can be enforced against the complex ownership structures of many (state-owned and subsidized) Chinese firms.

Sino-German economic interdependence will also be a major factor in the post-Covid-19 policy environment. From Berlin over Frankfurt to Munich export oriented corporate Germany is hoping that China can help pull domestic industries out of the economic consequences of the Covid-19 crisis. For German car manufacturers such a Sino-driven pull factor is essential. Industry leaders such as VW, Daimler and BMW anxiously follow the monthly data provided by the China Passenger Car Association on domestic demand and executed sales. But the pull factor works both ways. VW is investing two billion euros in the expansion of electric mobility in China. The industrial logic of such a significant investment volume is obvious: China is the lead market in EVs. VW wants to profit from the developments in this market in the coming years. This can primarily be achieved if one is on site in China.

“The emerging debates inside Germany on how to forge a post-Merkel strategy towards China are a challenging test case for the country’s credibility on the European stage.”

Geopolitical uncertainty and the political economy consequences of the Covid-19 pandemic will continue to shape Sino-German relations in the course of 2021. The departure of Ms. Merkel from the chancellery office following the general elections in Germany will be a watershed moment in the country, for the EU as well as how Berlin and Beijing establish a new modus vivendi in the years to come. The emerging debates inside Germany on how to forge a post-Merkel strategy towards China are a challenging test case for the country’s credibility on the European stage and beyond. At the corporate level German companies will want to avoid that investments in sensitive sectors are transformed from a business decision into a polarized public debate about its consequences for Sino-German relations. Whatever the outcome of such deliberations, they offer an opportunity to re-assess the rationale for and substance of Germany’s economic relations with China.

[1] Richthofen, Ferdinand von (1877): “Über die zentralasiatischen Seidenstrassen bis zum 2. Jahrhundert n. Chr.”, Verhandlungen der Gesellschaft für Erdkunde zu Berlin 4, pages 96-122.

[2] 2020 marked the 45th anniversary of the establishment of diplomatic relations between China and the European Union.

[3] CIA (1951): Information Report, Trade Between Communist China and East Germany, 3rd July 1951, online available: https://www.cia.gov/library/readingroom/document/cia-rdp82-00457r008000770010-2, accessed 03. December 2020.

[4] Zenglein, Max: “Mapping and recalibrating Europe’s economic interdependence with China”, MERICS, 17. November 2020.

[5] Data provided by Godement, François, “Europe’s pushback on China”, Policy Paper, Institut Montaigne, June 2020.

[6] A total of 15 West German companies (including Siemens, AEG, MAN) were part of the consortium involved in the cold rolling mill project. Equally, the German embassy in Beijing actively promoted the project. See Frankfurter Allgemeine Zeitung: “Für die Chinesen war die Qualität entscheidend”, 03. April 1974.

[7] See Frankfurter Allgemeine Zeitung: “Ein Staatsfonds gegen China”, 11. September 2019 and Handelsblatt: “Bedingt erfolgreich”, 28/30. November 2019.

[8] Large deviations of Chinese FDI per year in Germany should not be interpreted as outliers. Rather they can cumulatively have a dramatic impact in terms of a sector’s profile where acquisitions were made and/or the regulatory scrutiny such FDI may subsequently trigger. Both outcomes can be observed in the German car industry and the delayed reaction of government regulation in the field of investment screening by external, non-EU actors. The author of this article treats the exceptional as the starting point, while the ‘normal’ (years) are taken as subordinate.

[9] The national security grounds were based on Aixtron’s technology which includes devices to upgrade U.S. Patriot missile defense systems.

[10] In fact, China’s biggest hotelier acquired the parent company Deutsche Hospitality through its subsidiary China Lodging Holding Singapore. Steigenberger’s Europe-wide recognised brand name in the high-end hotel market was a key reason for the acquisition.

[11] See Frankfurter Allgemeine Zeitung: “Die deutschen Autohersteller verkaufen mehr Autos in China”, 25. January 2019.

[12] Rupert Stadler, the former CEO of Audi, a subsidiary of VW, characterized China in such a manner more than ten years ago.

[13] According to German capital market regulations, an investor can bypass information requirements below a three percent equity stake in a company if derivates and option calls are used to secure an additional two percent shareholding. The German Federal Financial Supervisory Authority (Bafin) was as surprised by Geely’s investment as were Daimler executives.

[14] Frankfurter Allgemeine Zeitung, “Deutsche Autokonzerne trauen sich China nicht allein zu”, 26. April 2018.

[15] How uneasy was illustrated when Daimler posted a quote from the Dalai Lama (in an advert for its luxury brand Mercedes-Benz) on its Instagram account in February 2018. It subsequently issued two (!) public apologies and withdrew the advertisement by expressing a “sincere apology to China.”

[16] Geely’s swelling automobile portfolio also includes shareholdings in Volvo Cars (Sweden), Lotus (British) and Proton (Malaysia). It is also the largest shareholder in the Swedish truck maker Volvo Group.

[17] Financial Times, “Is Chinese state behind Geely’s Daimler swoop?”, 28. February 2018, online available: https://www.ft.com/content/a9fcd724-1bbc-11e8-aaca-4574d7dabfb6, accessed 18. November 2020.

[18] See International Consortium of Investigative Journalists: “China Cables”, 24. November 2019, online available: https://www.icij.org/investigations/china-cables/, accessed 25. November 2020. The Chinese embassy in Berlin labels these documents as “fabricated”, a “myth” and “rumors”. Instead, it argues that the north-western region is a “melting pot of cultures.” The “vocational training centers” provide “deradicalization and integration activities”, see: Deuber, Lea and Frederik Obermaier: “China: Kritik verboten”, Süddeutsche Zeitung, 23. November 2020.

[19] Ankenbrand, Hendrik and Carsten Germis: “Was machen VW und Siemens in Xinjiang?”, Süddeutsche Zeitung, 27. November 2019.

[20] See Deuber, Lea and Frederik Obermaier: “China: Kritik verboten”, Süddeutsche Zeitung, 23. November 2020.

[21] But it was not HNA’s first investment in Germany. In 2016, it acquired the regional Hahn airport in Hunsrück near Wiesbaden and Frankfurt from the regional government for 15.1 million euro.

[22] Deutsche Bank is currently under investigation by the United States Justice Department (but not the German authorities!) for its hiring practices and use of consultants in China and other foreign countries, see The New York Times, International Edition, “Buying its way into China”, 16. October 2019.

[23] The ten percent threshold is the equity shareholding benchmark used by the OECD.

[24] Official Journal of the European Union: “REGULATION (EU) 2019/452 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL – Establishing a framework for the screening of foreign direct investments into the Union”, 19. March 2019, online available: https://eur-lex.europa.eu/eli/reg/2019/452/oj, accessed 25. March 2019. While these investment screening regulations were adopted, the EU-China investment agreement negotiations continue. The 33rd round of negotiations took place in October 2020.

[25] Such programmes include Galileo & EGNOS, Copernicus, Horizon 2020 and the European Defense Industrial Development Programme.

[26] Referentenentwurf (2020): Bundeswirtschaftsministerium für Wirtschaft und Energie, Erstes Gesetz zur Änderung des Außenwirtschaftsgesetzes, 31. January 2020, online available: https://www.bmwi.de/Redaktion/DE/Pressemitteilungen/2020/20200131-altmaier-sicherheitsinteressen-vorausschauender-schuetzen.html, accessed 24. February 2020.

[27] 50Hertz’s transmission grid supplies approximately 18 million citizens with electricity across Germany. The KfW acquired the 20 percent shareholding from Belgium’s Elia System Operator. For more details see: Rogers, Iain and Arne Delfs: “Germany steps up efforts to rebuff China’s swoop for assets”, Bloomberg, 27. July 2018.

[28] Frankfurter Allgemeine Zeitung: “FDP kritisiert Hilfe für China”, 15. September 2019.

[29] Thomas, Andrea: “Germany vetoes Chinese purchase of business citing security grounds”, The Wall Street Journal, 26. July 2018, online available: https://www.wsj.com/articles/germany-vetoes-chinese-purchase-of-leifeld-metal-spinning-1532624172, accessed 26. November 2020.

[30] In February 2020, the U.S. administration expanded the authority of the Committee of Foreign Investment (Cfius). The Committee can now block acquisitions of minority shareholdings, not just takeovers. Cfius also received greater jurisdiction to cover more sectors of the U.S. economy, including for the first time, real estate. Similarly, in November 2020, the U.K. government proposed new legislation to block foreign takeovers of British companies. Investors would have to notify the government about transactions in 17 sectors including nuclear energy, artificial intelligence, transport, energy supply and defense. Britain’s draft law brings it closer in line with Germany’s existing rules.

[31] Löhr, Julia: “Altmaiers Lehren aus dem Fall Kuka”, Frankfurter Allgemeine Zeitung, 29. November 2019.

[32] Schulz, Florence (2019): „Industriestrategie 2030: Altmaier setzt auf „European Champions“, EURACTIV.de, 06. February 2019, online available: https://www.euractiv.de/section/finanzen-und-wirtschaft/news/industriestrategie-2030-altmaier-setzt-auf-european-champions/, accessed 10. September 2019.

[33] VDMA (Verband Deutscher Maschinen- und Anlagenbau – German Engineering Federation) is the largest engineering industry network in Europe. See Frankfurter Allgemeine Zeitung, “Wir brauchen nicht mehr Schutz vor China”, 07. September 2018.

[34] Electrive.com: “CATL starts building battery plant in Germany”, 19. October 2019, online available: https://www.electrive.com/2019/10/19/catl-starts-building-battery-plant-in-germany/, accessed 27. November 2020.

[35] See RailTech.com: “CRRC gets green light to purchase Vossloh Locomotives”, 28. April 2020, online available: https://www.railtech.com/policy/2020/04/28/crrc-gets-green-light-to-purchase-vossloh-locomotives/?gdpr=deny, accessed 23. November 2020.

[36] Heymann, Eric (2020): “German auto industry: Output in China exceeds domestic production”, Deutsche Bank Research, 09. March 2020, online available: https://www.dbresearch.com/servlet/reweb2.ReWEB?rwsite=RPS_EN-PROD&rwobj=ReDisplay.Start.class&document=PROD0000000000505697, accessed 01. December 2020.

[37] The cargo handling hubs in the port constitute the Duisburg Intermodal Terminal (DIT) where one third of arriving trains are from China. The growing China business in Duisburger Port AG (Duisport) has served as a catalyst for other Chinese companies such as Starhai to build a 260 million euro China Trade Centre Europe in the city (see Financial Times, “World’s biggest inland port puts German rust belt on China’s map”, 10. April 2019 and Duisport: “Stability in difficult times: The Port of Duisburg continues to grow in 2019”, 21. April 2020, online available: https://www.duisport.de/stability-in-difficult-times-the-port-of-duisburg-continues-to-grow-in-2019/?lang=en, accessed 25. November 2020.

[38] In the neighbouring cities of Gelsenkirchen and Bochum, in September 2019 the public transport company Bogestra ordered electric buses from the Chinese electric automotive company BYD (Build Your Dreams). It was the first e-bus order for BYD from Germany. The order is financed by regional and federal public funding. Despite the Covid-19 pandemic, delivery of all 22 e-buses was completed in October 2020.

[39] Bastian, Jens: “Southeast Europe in current Chinese foreign economic policy”, Südosteuropa Mitteilungen, Vol. 60, No. 3 / 2020, pp. 13-28.

[40] Redeker, Niels and Anna Stahl: “Pushed by the pandemic. Shaping Europe’s changing geo-economic relations with China”, Hertie School – Jacques Delors Center, Policy Paper, 16. November 2020.

[41] Czuczka, Tony and Steven Arons: “China threatens retaliation should Germany ban Huawei 5G”, Bloomberg, 15. December 2019, online available: https://www.bloomberg.com/news/articles/2019-12-14/china-threatens-germany-with-retaliation-if-huawei-5g-is-banned, accessed 29. November 2020. Delivering threats on German soil by a Chinese diplomat also occurred when China’s Minister of Foreign Affairs, Mr. Wang Yi visited Berlin in September 2020. During a press conference with his German counterpart, Mr. Heiko Maas, Mr. Wang attacked the president of the Czech Senate, Mr. Milos Vystrcil, who had recently visited Taiwan as follows: “The Chinese government and Chinese people won’t take a laissez-faire attitude or sit idly by and will make him pay a heavy price for his shortsighted behavior and political opportunism.” See Steven Lee Myers: “China, seeking a friend in Europe, finds rising anger and frustration”, The New York Times, 17. September 2020, online available: https://www.nytimes.com/2020/09/17/world/asia/china-europe-xi-jinping.html, accessed 24. September 2020.

[42] Frankfurter Allgemeine Zeitung: “Rheinmetall beliefert Huawei”, 12. December 2019.

[43] Cerulus, Laurens: “How US restrictions drove Deutsche Telekom and Huawei closer together”, Politico, 06. July 2020, online available: https://www.politico.eu/article/deutsche-telekom-huawei-us-security-measures/, accessed 04. August 2020.

[44] Precht, David: “Vodafone Germany: Huawei exclusion would delay 5G expansion by 5 years”, Tech Scurry, 30. October 2020, online available: https://techscurry.com/general/vodafone-germany-huawei-exclusion-would-delay-5g-expansion-by-5-years/18375/, accessed 02. December 2020.

[45] Koch, Moritz: “Huawei-Ausschluss rückt näher”, Handelsblatt, 13. December 2020.

[46] BDI (2019): “China – Partner und systemischer Wettbewerber. Wie gehen wir mit Chinas staatlich gelenkter Volkswirtschaft um?“ Position Paper, January 2019, online available: https://bdi.eu/media/publikationen/#/publikation/news/china-partner-und-systemischer-wettbewerber/, accessed 10. September 2019.

[47] The new 14-country Pew Research Center survey is based on cross-national views of China. Due to the coronavirus outbreak, the study was conducted in countries where nationally representative telephone surveys are feasible. The report used data from nationally representative surveys of 14,276 adults from June 10 to Aug. 3, 2020, in 14 advanced economies. All surveys were conducted over the phone with adults in the U.S., Canada, Belgium, Denmark, France, Germany, Italy, the Netherlands, Spain, Sweden, the UK, Australia, Japan and South Korea.

[48] Laura Silver, Kat Devlin and Christine Huang (2020): ‘Unfavorable views of China reach historic highs in many countries’, 06. October 2020, online available: https://www.pewresearch.org/global/2020/10/06/unfavorable-views-of-china-reach-historic-highs-in-many-countries/#in-europe-more-see-china-as-worlds-top-economic-power-than-u-s, accessed 02. November 2020.